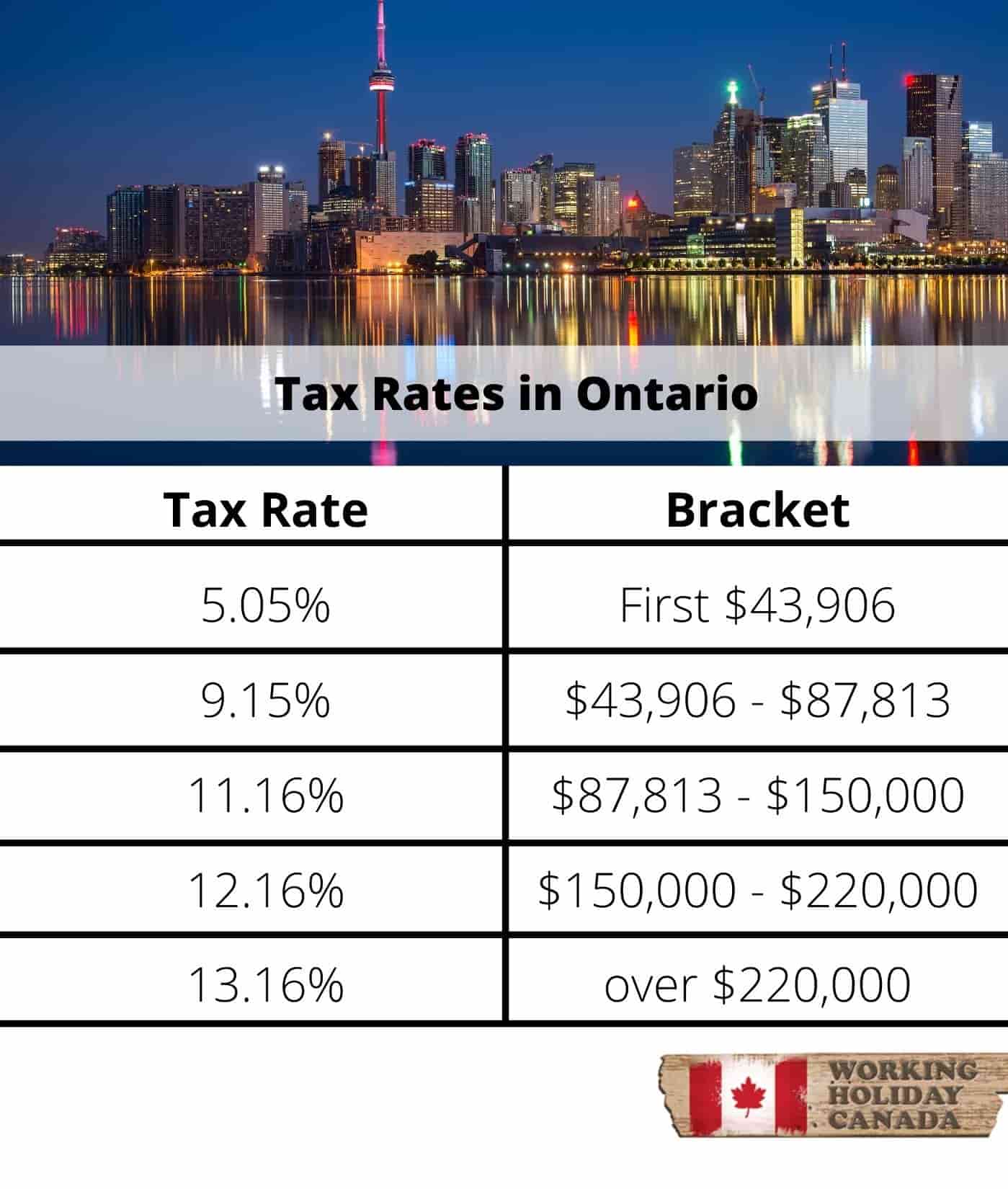

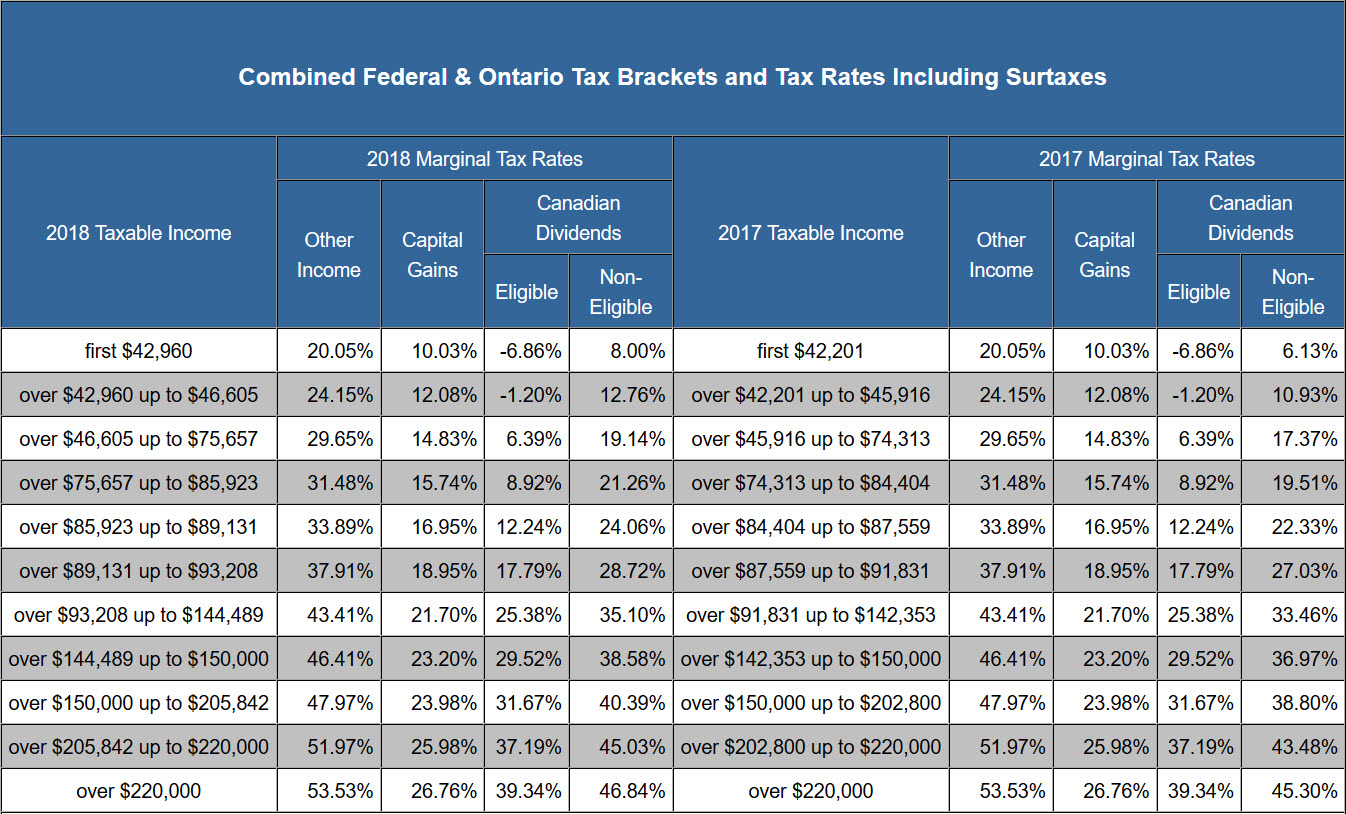

2025 Tax Brackets Canada. 2025 federal income tax rates. There are also various tax credits, deductions and benefits available to you to reduce your total tax payable.

They go up each year by the same amount as the price level, in order to prevent ‘bracket creep. Here are all the major changes taking place in 2025:

2025 Tax Brackets Ontario Ca Rica Shelli, This edition of tax facts covers key tax information including:

Tax Brackets 2025 Canada Arabel Dorette, Federal and provincial/territorial personal tax rates, brackets, surtaxes, and credits;

Tax Brackets 2025 Canada Bc Eugine Opalina, Your tax bracket is based on “taxable income,” which is your gross income from all sources, minus any tax deductions you may qualify for.

Rate Cuts 2025 Canada 2025 Grete Kathlin, Federal and provincial/territorial personal tax rates, brackets, surtaxes, and credits;

2025 Tax Brackets Canada Mandi Rozella, Estimate your income taxes with our free canada income tax calculator.

2025 Tax Brackets Canada Ontario Elke Oralee, 4.1, 4.3, 4.52, 4.69 the bc tax brackets and personal tax credit amounts are increased for 2025 by an indexation factor of 1.028 (2.8% increase).

2025 Tax Brackets Canada Single Flossi Rachel, Want an idea of how much tax you paid—or will be paying—for 2025?

2025 Tax Brackets Canada With Dependents Fionna Korella, Alberta's top capital gains rate of 24% will instead be 32% [24% x 1 ⅓]).

Best Dishwasher 2025 For The Money Online. These include value for money, performance, features and. […]

Pittsburgh Steelers Football Roster 2025. Pittsburgh steelers player information and depth chart order. The pittsburgh […]